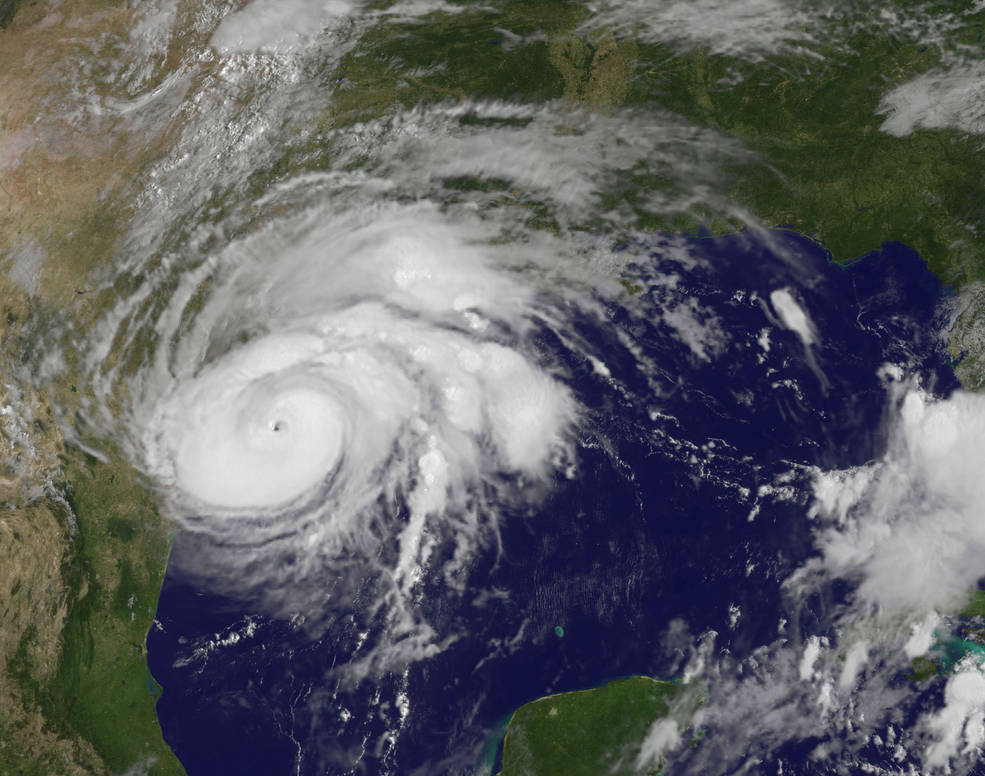

Thousands of people in Southeast Texas lost their homes and their possessions after the historic flooding this weekend. Though the worst of the hurricane is over, widespread flooding still ensues and many will be struggling to recover for some time. Some of those in the area will be filing flood insurance claims to try to get back on their feet – and need to be aware of crucial changes that will be coming as early as Friday in the way insurance companies will handle these claims.

A new insurance bill takes effect on Friday, September 1st, to replace Texas Insurance Code 542, and may seriously damper one’s ability to recover from flood losses. Here are some facts about the new bill:

The new bill guts the penalty that your insurance company may owe you should they not pay you a fair value for your claim. If you file a claim now, before the new bill goes into effect, you can claim 18% penalty interest, plus attorneys’ fees, in the event that the insurance company does not cover your damages per your policy. However, if you wait until Friday, September 1st, by law that penalty interest will now effectively be only 10 percent. Several critics of the new law have stated that the lower interest penalty purely acts as a disincentive to pay the fair value on a claim. The point is, file NOW and do not put it off.

Also remember that the burden to investigate the flood damage is on the insurance company, NOT you, and that there are several guidelines in place to make sure the insurance company thoroughly investigates.

Despite the fact that you may not yet know the extent of the damage done by recent flooding, it is very important to act quickly to ensure that your insurance company must abide by the current harsher penalty, should they not pay the full value of your claim.

Also remember that these insurance claims MUST be made in writing (we recommend certified mail via USPS for tracking purposes, but email also works), and not by phone. Make sure that you state in your letter or email that you want them to FILE A CLAIM BEFORE FRIDAY.

Read more about these impending changes in state law on how insurance will protect you from natural disasters: https://www.lexology.com/library/detail.aspx?g=244cbcdf-3192-4367-9b25-de323d19c615